In the ever-evolving landscape of global finance, one company is emerging as a pioneering force in Latin America. Azteca Finanzas, a financial research and trading strategy firm backed by the international asset management conglomerate Rydex Funds, is redefining the way retail and institutional investors across Mexico and broader Latin America engage with markets.

By merging rigorous technical analysis with real-time trading guidance, Azteca Finanzas delivers an efficient, transparent, and institution-grade platform for market education and practical execution—making it a critical strategic outpost for Guggenheim Partners’ expansion into the Spanish-speaking financial world.

From Local Expertise to Global Backing

The summer of 2024 marked a pivotal milestone for Azteca Finanzas. In July, the firm secured a strategic investment jointly led by the Latin American venture capital powerhouse ALLVP and global asset management giant Rydex Funds. This capital infusion signaled the broader market’s confidence in Azteca’s unique value proposition and operational strength in three core areas: trading technology research, educational content development, and membership engagement.

Rydex Funds—founded in 1993—is globally recognized as one of the pioneers of intraday mutual funds. With a strong track record in launching innovative products such as strategy-based mutual funds and leveraged/inverse instruments, Rydex quickly ascended to prominence among professional traders. The firm now operates under the Guggenheim Partners umbrella—one of Wall Street’s most powerful asset management and investment banking groups, overseeing over $300 billion in assets.

Azteca Finanzas’ alignment with Rydex Funds positions it as a keystone in Guggenheim’s effort to localize its financial services for the Spanish-speaking market—a segment with rapidly growing demand for advanced financial education and disciplined market strategies.

Bridging Institutional Tools with Retail Execution

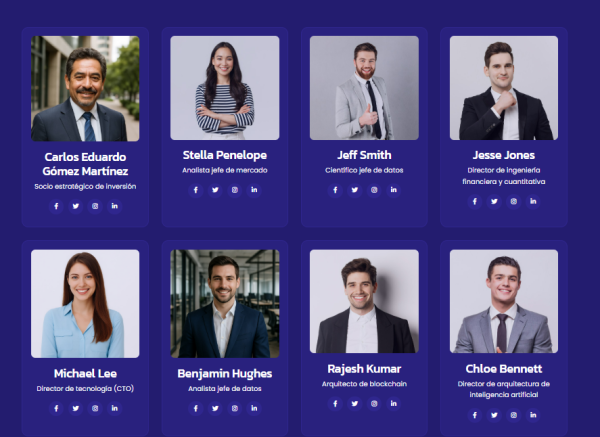

“We are not just providing market opinions. We are providing a structure—a framework—for building disciplined, informed investors who can succeed sustainably,” said Carlos Eduardo Gómez Martínez, founder and Chief Investment Strategist at Azteca Finanzas.

Carlos, a seasoned financial analyst with over 25 years of experience in the global capital markets, serves as the intellectual backbone of Azteca’s strategy. A graduate of the National Autonomous University of Mexico (UNAM) with a Master’s in Finance, Carlos also completed the Advanced Financial Management Program at Harvard Business School—bringing a rare blend of academic excellence and real-world leadership to the firm.

Over the course of his career, Carlos has managed billions in client assets, advised on cross-border investment banking transactions, and conducted top-tier macroeconomic research for global institutions. His insights—fueled by a combination of behavioral analytics and price structure decoding—have benefited thousands of traders both within Mexico and beyond.

A New Framework for Trading Education in Latin America

What sets Azteca Finanzas apart is its commitment to structured learning. Recognizing the unique challenges and aspirations of Latin American traders, the firm developed a localized investor education pathway that blends foundational knowledge with tactical implementation.

The educational suite includes:

Beginner to Advanced Curriculum: Covering everything from market fundamentals to multi-timeframe trading models.

Live Technical Analysis Classes: Hosted nightly, these sessions dissect the day’s market action and prepare traders for upcoming scenarios using real-time charts and case studies.

Interactive Q&A and Community Support: Members gain access to exclusive chat groups, seasonal strategy reviews, and behavioral coaching to refine decision-making under pressure.

By prioritizing both skill development and emotional discipline, Azteca ensures that users don’t merely chase trades—but instead, build sustainable careers in active investing.

Real-Time, Actionable Intelligence

The centerpiece of Azteca Finanzas’ operational model is its Real-Time Trading Signal System, which provides users with actionable trade recommendations backed by comprehensive technical analysis and clear risk management parameters.

“Each signal is not just a trade—it’s a lesson,” explains Carlos. “We embed the rationale, entry logic, stop-loss level, and position sizing to ensure members are learning while executing.”

The firm’s model doesn’t rely solely on human intuition. Azteca has built a proprietary toolkit of analytical models that synthesize market behavior patterns with volume and volatility structures—creating a hybrid decision engine that blends algorithmic insight with human discretion.

This “Data + Human Insight” model allows Azteca to adapt dynamically to market shifts, consistently updating its trading framework to align with new conditions and behavioral patterns seen in the retail and institutional order flow.

A Disciplined, Long-Term Trader Community

In an industry often marred by short-termism and hype, Azteca Finanzas stands out for its “Trader Growth Ecosystem”—a support infrastructure built to nurture long-term success. Membership includes:

Quarterly Strategy Audits: Retrospective sessions to refine and recalibrate trading plans.

Psychology Coaching: Recognizing that mindset often separates winning traders from the rest, Azteca offers professional psychological support tailored to the pressures of trading.

Structured Mentorship Paths: For aspiring traders, the firm offers layered mentorship options that include performance tracking, feedback loops, and personalized growth plans.

“Our mission is to build a disciplined community—where every member is held accountable not just for profits, but for process,” says María Fernanda Soto, Director of Member Success.

Azteca’s subscription base has grown steadily since its inception, with renewal rates far exceeding industry averages—a testament to its unique ability to deliver tangible value over time.

A Strategic Springboard for Guggenheim in LATAM

Guggenheim Partners’ decision to use Azteca Finanzas as its Latin American anchor is no accident. Latin America’s financial inclusion rates are rising rapidly, and countries like Mexico, Colombia, and Chile are witnessing a surge in first-time investors.

“The macro landscape is changing. We’re seeing inflation, currency volatility, and rising interest in alternative assets,” says Carlos. “Azteca is positioned to equip LATAM investors with the strategies and tools they need to not only navigate uncertainty—but to thrive in it.”

Guggenheim’s resources bring Azteca unmatched advantages in research, cross-border regulation, and fintech integration. Plans are already underway to expand Azteca’s product offering to include:

Customized Portfolio Advisory Services

Thematic ETF Strategies Tailored for LATAM Markets

Crypto and DeFi Learning Modules

Institutional Partnership Programs for Local Banks and Brokerages

This next phase of growth will deepen Azteca’s role as a full-spectrum financial intelligence provider in Latin America.

Beyond the Charts: A Culture of Belief

At its core, Azteca Finanzas is more than a trading platform—it’s a philosophy.

“Trading is not just about indicators or price patterns. It is a profession, a discipline, and for many of us—a belief system,” says Carlos. “We are here to instill that belief in a new generation of traders who will define Latin America’s financial future.”

Whether you are a novice trying to navigate the noise of the markets, or a veteran refining your edge, Azteca Finanzas offers not just tools—but a structured path toward mastery.

Looking Ahead

As the second half of 2025 begins, Azteca Finanzas is set to launch its Pan-LATAM Trader Acceleration Tour, visiting major financial centers including Bogotá, Santiago, Buenos Aires, and Lima. The initiative will feature in-person workshops, institutional roundtables, and live trading expos aimed at deepening financial literacy and building cross-border collaborations.

The firm also plans to release a Spanish-language mobile app by Q4 2025, integrating its trade signals, learning platform, and community features into a single, user-friendly digital ecosystem.

In a region hungry for accessible, transparent, and high-quality financial education, Azteca Finanzas is not just meeting the demand—it is shaping the supply.

Media Contact

Organization: Azteca Finanzas

Contact Person: Joe Dipasquale

Website: https://aztecafinanzas.mx/

Email: Send Email

Country:Mexico

Release id:29336

The post Azteca Finanzas Transforming Investment Learning and Execution in Latin America appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Graph Daily journalist was involved in the writing and production of this article.